The Federal Reserve is back in focus for stock markets as traders speculate whether rate cuts will come soon enough

-

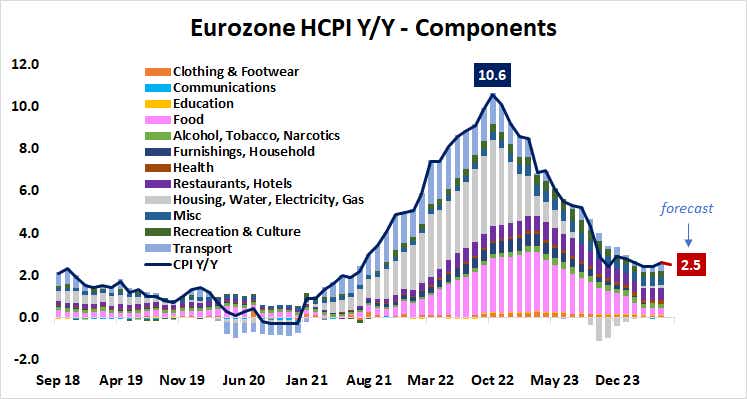

Euro could fall as Eurozone CPI inflation data calls for more ECB rate cuts.

-

FOMC meeting minutes and Powell’s speech could set the stage for markets.

-

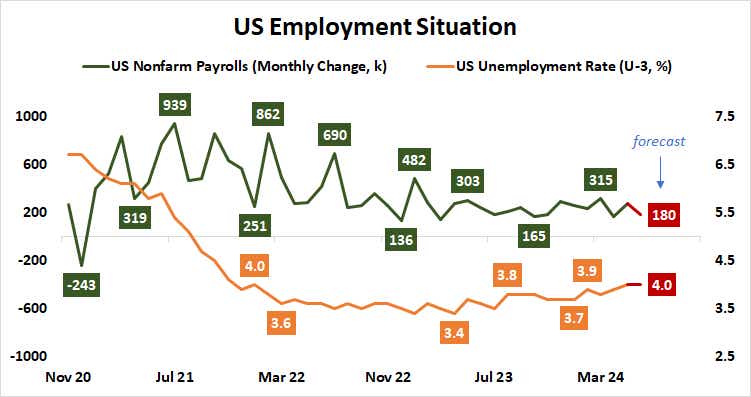

US jobs data may be soft. What this means for stocks depends on the context.

Wall Street continued to struggle for sustainable direction in last week’s trade. The bellwether S&P 500 fell 0.2%, having added a similar 0.6% last week. The technology-oriented Nasdaq 100 fell 0.3% after rising 0.2%. Gold prices were also uncomfortable. Absent another headwind against the Japanese yen, the US dollar was also calm.

A “bearish bullish” dynamic is playing out in the Treasury bond market. The 2-10-year yield spread widened at the fastest pace in six months. Such moves often signal concern about inflation and tighter rates going forward, although the outlook for the Federal Reserve’s interest rate policy has changed little.

A curious week is ahead. On the one hand, the economic calendar is fraught with the risk of high-profile events. On the other hand, the Independence Day holiday will produce another midweek market close. This, along with partial trading days for major exchanges in the days before and after the 4th of July holiday, is likely to mean poor liquidity and volatile price action.

Against this backdrop, here are the macro points that could shape what comes next.

Eurozone consumer price index (CPI) data

Eurozone inflation is expected to cool to 2.5% year-on-year when June data is released this week. That would leave total price growth within the 2.4-2.6% range it has occupied since February.

Last month’s shockingly disappointing purchasing managers’ index (PMI) figures suggest growth has hit a wall after strengthening in the first half of the year following a shallow recession at the end of 2023. German CPI data from data earlier this week already indicated that this is putting more downward pressure on prices than expected, and results across the region could follow suit.

For traders, such results could mean more room for rate cuts by the European Central Bank (ECB), especially after parliamentary elections in France suggested that the scope for supporting fiscal policy has been reduced by political gridlock. On balance, this could be bad for the euro and eurozone stocks alike.

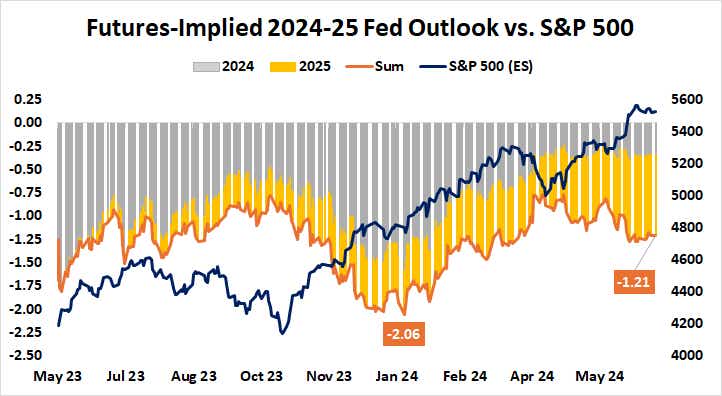

FOMC meeting minutes and Fed Chairman Powell’s speech

The Federal Reserve is set to release the minutes from June’s fateful Federal Open Market Committee (FOMC) meeting. That cut produced an updated set of economic projections that reduced the scope for stimulus while removing the inflation forecast, formalizing the central bank’s “higher for longer” mentality on the way to interest rates.

Traders will be keen to learn whether officials factored May’s consumer price index (CPI) data into their thinking. Released a day before the Fed’s policy decision, it appeared to imply that disinflation is regaining momentum. The same has since appeared in the central bank’s favored gauge of personal consumption expenditure (PCE) price growth.

These, along with Fed Chairman Jerome Powell’s comments at the ECB’s annual Central Bank Forum in Sintra, Portugal, will be closely watched to see if the US authorities have grown more optimistic about meeting the target of of inflation in recent weeks. Risk appetite can thrive if it appears to be the case, and sour if not.

US employment data

The economy added 180,000 jobs last month, while the unemployment rate remained unchanged at 4%, according to baseline forecasts. Such results would fall within the narrow range of results that determine US labor market conditions for more than a year.

Analysis by Citigroup shows that US economic data results have increasingly underperformed expectations recently. In fact, the bank’s closely watched Economic Surprises Index (ESI) now shows the widest margin of disappointment in 11 months.

That could tip the scales toward a greater probability of negative surprises when job data hits the wire. If that happens as the Fed appears to have become more confident about disinflation, stocks are likely to cheer as rate cuts look closer. However, risk appetite could crumble if soft data comes in as officials are reluctant to stimulate.

Ilya Spivak, delicious head of global macro, has 15 years of experience in trading strategy and he specializes in identifying thematic movements in currencies, commodities, interest rates and stocks. Hey host Macro money and co-hosts overtime, Monday-Thursday. @Ilyaspivak

For daily live programming, market news and commentaryVisit delicious or YouTube channels delicious (for options traders), and Delicious trend for stocks, futures, forex and macro.

Trade with a better broker, open a keyboard account today. delicious, inc. and tastytrade, Inc. they are separate but related companies.

#Stock #markets #suffer #FOMC #minutes #Powells #speech #signal #delay #rate #cuts

Image Source : www.tastylive.com